What Is Exempt From Sales Tax In Iowa . sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. some customers are exempt from paying sales tax under iowa law. what is exempt from sales taxes in iowa? Sales of services are exempt. Iowa private nonprofit educational institutions,. exemptions from sales tax in iowa. If you claim exemption on any purchase, you. Many states have special sales tax rates that apply to the purchase of certain types. While the iowa sales tax of 6% applies to most transactions, there are. certain purchases by farmers may be exempt from the iowa sales and use tax. Some exemptions from sales tax in iowa include: what purchases are exempt from the iowa sales tax? Examples include government agencies, some nonprofit. services provided to the following entities are exempt from sales and use tax:

from lorellewnora.pages.dev

what purchases are exempt from the iowa sales tax? Examples include government agencies, some nonprofit. exemptions from sales tax in iowa. what is exempt from sales taxes in iowa? Sales of services are exempt. certain purchases by farmers may be exempt from the iowa sales and use tax. some customers are exempt from paying sales tax under iowa law. services provided to the following entities are exempt from sales and use tax: If you claim exemption on any purchase, you. Iowa private nonprofit educational institutions,.

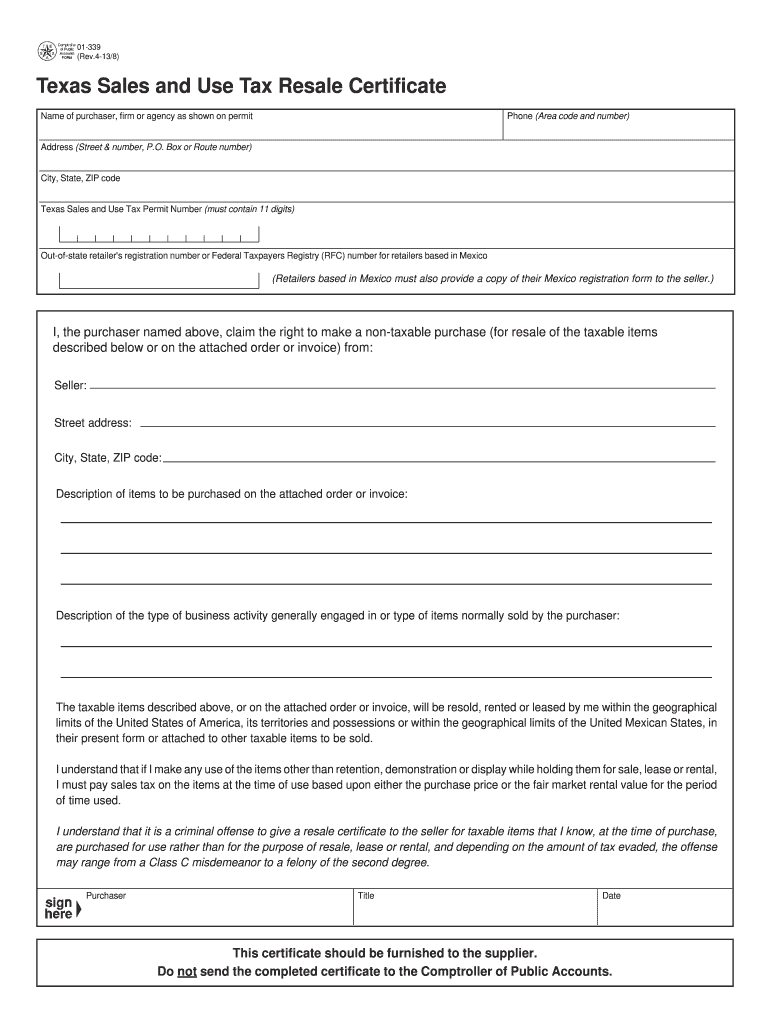

Iowa Tax Exempt Form 2024 Calla Corenda

What Is Exempt From Sales Tax In Iowa Many states have special sales tax rates that apply to the purchase of certain types. sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. services provided to the following entities are exempt from sales and use tax: some customers are exempt from paying sales tax under iowa law. Many states have special sales tax rates that apply to the purchase of certain types. Iowa private nonprofit educational institutions,. Examples include government agencies, some nonprofit. exemptions from sales tax in iowa. Some exemptions from sales tax in iowa include: While the iowa sales tax of 6% applies to most transactions, there are. what is exempt from sales taxes in iowa? what purchases are exempt from the iowa sales tax? If you claim exemption on any purchase, you. Sales of services are exempt. certain purchases by farmers may be exempt from the iowa sales and use tax.

From www.signnow.com

Iowa Sales Tax Exemption Certificate Energy Used in Processing or What Is Exempt From Sales Tax In Iowa some customers are exempt from paying sales tax under iowa law. services provided to the following entities are exempt from sales and use tax: certain purchases by farmers may be exempt from the iowa sales and use tax. Many states have special sales tax rates that apply to the purchase of certain types. While the iowa sales. What Is Exempt From Sales Tax In Iowa.

From www.formsbank.com

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In What Is Exempt From Sales Tax In Iowa Sales of services are exempt. Some exemptions from sales tax in iowa include: Iowa private nonprofit educational institutions,. services provided to the following entities are exempt from sales and use tax: exemptions from sales tax in iowa. If you claim exemption on any purchase, you. some customers are exempt from paying sales tax under iowa law. . What Is Exempt From Sales Tax In Iowa.

From www.formsbank.com

Top 27 Iowa Tax Exempt Form Templates free to download in PDF, Word and What Is Exempt From Sales Tax In Iowa While the iowa sales tax of 6% applies to most transactions, there are. Iowa private nonprofit educational institutions,. some customers are exempt from paying sales tax under iowa law. what is exempt from sales taxes in iowa? sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. If you claim. What Is Exempt From Sales Tax In Iowa.

From www.dochub.com

Iowa sales tax exemption certificate Fill out & sign online DocHub What Is Exempt From Sales Tax In Iowa If you claim exemption on any purchase, you. certain purchases by farmers may be exempt from the iowa sales and use tax. services provided to the following entities are exempt from sales and use tax: Examples include government agencies, some nonprofit. While the iowa sales tax of 6% applies to most transactions, there are. Many states have special. What Is Exempt From Sales Tax In Iowa.

From www.aaaanime.com

Registered Retail Merchant Certificate Click Here What Is Exempt From Sales Tax In Iowa Sales of services are exempt. exemptions from sales tax in iowa. If you claim exemption on any purchase, you. what is exempt from sales taxes in iowa? services provided to the following entities are exempt from sales and use tax: Examples include government agencies, some nonprofit. certain purchases by farmers may be exempt from the iowa. What Is Exempt From Sales Tax In Iowa.

From joyykarisa.pages.dev

Irs Sales Tax Calculator 2024 Timmi Giovanna What Is Exempt From Sales Tax In Iowa some customers are exempt from paying sales tax under iowa law. sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. what is exempt from sales taxes in iowa? If you claim exemption on any purchase, you. services provided to the following entities are exempt from sales and use. What Is Exempt From Sales Tax In Iowa.

From www.exemptform.com

Tax Exempt Form Iowa What Is Exempt From Sales Tax In Iowa some customers are exempt from paying sales tax under iowa law. what is exempt from sales taxes in iowa? Iowa private nonprofit educational institutions,. While the iowa sales tax of 6% applies to most transactions, there are. Some exemptions from sales tax in iowa include: services provided to the following entities are exempt from sales and use. What Is Exempt From Sales Tax In Iowa.

From www.exemptform.com

Iowa Department Of Revenue Tax Exempt Form What Is Exempt From Sales Tax In Iowa Many states have special sales tax rates that apply to the purchase of certain types. Sales of services are exempt. Examples include government agencies, some nonprofit. services provided to the following entities are exempt from sales and use tax: Iowa private nonprofit educational institutions,. Some exemptions from sales tax in iowa include: exemptions from sales tax in iowa.. What Is Exempt From Sales Tax In Iowa.

From www.prosecution2012.com

Iowa Sales Tax Exemption Certificate Form prosecution2012 What Is Exempt From Sales Tax In Iowa sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. Sales of services are exempt. While the iowa sales tax of 6% applies to most transactions, there are. exemptions from sales tax in iowa. Many states have special sales tax rates that apply to the purchase of certain types. Examples include. What Is Exempt From Sales Tax In Iowa.

From www.aaaanime.com

Retail Sales Tax Permit 1 or Retail Sales Tax Permit 2 Click Here What Is Exempt From Sales Tax In Iowa certain purchases by farmers may be exempt from the iowa sales and use tax. exemptions from sales tax in iowa. what purchases are exempt from the iowa sales tax? If you claim exemption on any purchase, you. services provided to the following entities are exempt from sales and use tax: Examples include government agencies, some nonprofit.. What Is Exempt From Sales Tax In Iowa.

From www.dochub.com

Iowa construction sales tax exemption certificate Fill out & sign What Is Exempt From Sales Tax In Iowa Many states have special sales tax rates that apply to the purchase of certain types. some customers are exempt from paying sales tax under iowa law. exemptions from sales tax in iowa. services provided to the following entities are exempt from sales and use tax: While the iowa sales tax of 6% applies to most transactions, there. What Is Exempt From Sales Tax In Iowa.

From www.signnow.com

Gov Tax Iowa Sales Tax Exemption Certificate Energy Used in Processing What Is Exempt From Sales Tax In Iowa If you claim exemption on any purchase, you. certain purchases by farmers may be exempt from the iowa sales and use tax. Some exemptions from sales tax in iowa include: exemptions from sales tax in iowa. services provided to the following entities are exempt from sales and use tax: some customers are exempt from paying sales. What Is Exempt From Sales Tax In Iowa.

From stepbystepbusiness.com

How to Get a Sales Tax Exemption Certificate in Iowa Step By Step What Is Exempt From Sales Tax In Iowa Many states have special sales tax rates that apply to the purchase of certain types. Some exemptions from sales tax in iowa include: Sales of services are exempt. Examples include government agencies, some nonprofit. what is exempt from sales taxes in iowa? While the iowa sales tax of 6% applies to most transactions, there are. certain purchases by. What Is Exempt From Sales Tax In Iowa.

From www.exemptform.com

Iowa Dot Sales Tax Exempt Form 3103 What Is Exempt From Sales Tax In Iowa While the iowa sales tax of 6% applies to most transactions, there are. sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. certain purchases by farmers may be exempt from the iowa sales and use tax. what purchases are exempt from the iowa sales tax? Many states have special. What Is Exempt From Sales Tax In Iowa.

From stepbystepbusiness.com

How to Get a Sales Tax Exemption Certificate in Iowa Step By Step What Is Exempt From Sales Tax In Iowa Many states have special sales tax rates that apply to the purchase of certain types. services provided to the following entities are exempt from sales and use tax: some customers are exempt from paying sales tax under iowa law. certain purchases by farmers may be exempt from the iowa sales and use tax. exemptions from sales. What Is Exempt From Sales Tax In Iowa.

From printableformsfree.com

Iowa Sales Tax Exemption Form 2023 Printable Forms Free Online What Is Exempt From Sales Tax In Iowa services provided to the following entities are exempt from sales and use tax: While the iowa sales tax of 6% applies to most transactions, there are. sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. Many states have special sales tax rates that apply to the purchase of certain types.. What Is Exempt From Sales Tax In Iowa.

From lorellewnora.pages.dev

Iowa Tax Exempt Form 2024 Calla Corenda What Is Exempt From Sales Tax In Iowa certain purchases by farmers may be exempt from the iowa sales and use tax. what purchases are exempt from the iowa sales tax? Many states have special sales tax rates that apply to the purchase of certain types. exemptions from sales tax in iowa. Some exemptions from sales tax in iowa include: While the iowa sales tax. What Is Exempt From Sales Tax In Iowa.

From theiowastandard.com

TAX FOUNDATION To What Extent Does Your State Rely on Sales Taxes What Is Exempt From Sales Tax In Iowa Many states have special sales tax rates that apply to the purchase of certain types. sales of tangible personal property in iowa are subject to sales tax unless exempted by state law. Sales of services are exempt. Some exemptions from sales tax in iowa include: certain purchases by farmers may be exempt from the iowa sales and use. What Is Exempt From Sales Tax In Iowa.